As a CPA, deep knowledge of US GAAP is essential and extensively tested. You likely apply it regularly in reporting and compliance.

Arifur Rahman Khan

I am a staff accountant with 8+ years of experience

What I Do

Professional Skills

US GAAP (Generally Accepted Accounting Principles)

Bookkeeping

Reason: While bookkeeping is more operational, your background ensures a strong understanding, especially for oversight and review.

Payroll

You likely understand payroll processes, taxation, and compliance, though it may not be a primary focus unless you’ve worked in payroll-heavy roles.

Tax (Corporate & Individual)

With CPA training, tax compliance and planning is a core skill. You likely have strong knowledge of federal, state, and corporate tax structures.

Financial Reporting

Both CPA and CMA emphasize accurate, timely, and compliant financial reporting. You’re likely skilled in preparing and analyzing financial statements.

Budget & Forecasting

A CMA focuses heavily on forward-looking financial planning, budgeting, and forecasting models. You should excel in this area.

Cost Analysis / Cost Accounting

This is a cornerstone of the CMA curriculum. You likely have advanced skills in cost allocation, variance analysis, and margin optimization.

Inventory Management

As a CMA, you'd be trained in inventory costing methods and controls. While not always hands-on, your understanding of valuation and analysis should be solid.

Sales Analysis

While this is more of a management and decision-support function, CMAs are expected to analyze revenue trends, pricing strategies, and market performance.

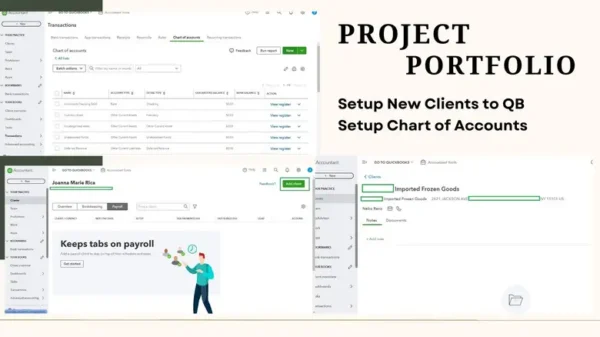

Portfolio

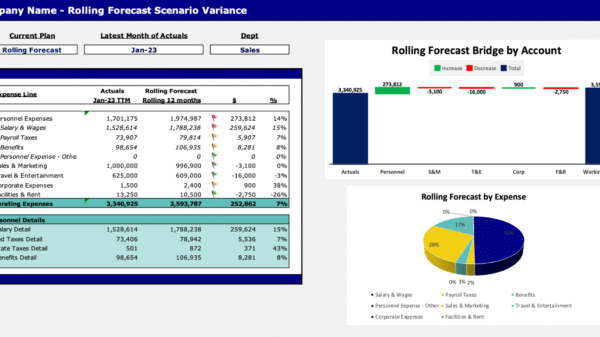

Financial Analysis and Forecasting

Data-driven financial analysis and forecasting to support smart business decisions. We help you understand key financial metrics, project future performance, and plan for sustainable growth.

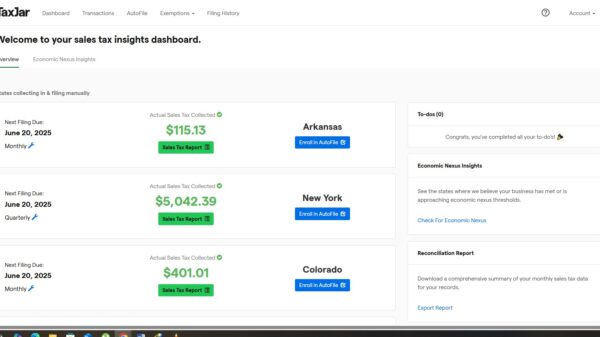

Sales Tax (Registration and Submission) – TaxJar, Avalara

End-to-end sales tax services, including registration, calculation, and submission using platforms like TaxJar and Avalara. Stay compliant across multiple jurisdictions with ease and confidence.

Payroll report

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

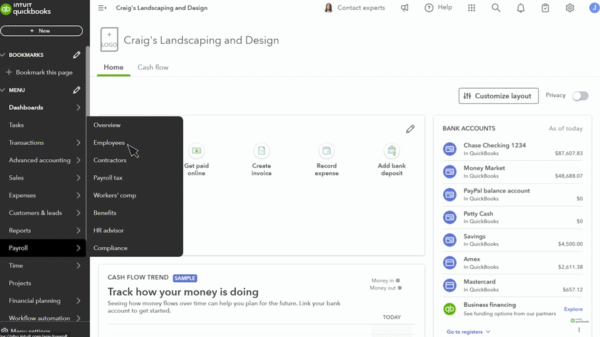

Payroll Services (Gusto, QuickBooks, ADV)

Reliable and compliant payroll solutions using platforms like Gusto, QuickBooks, and ADV. We manage everything from employee setup to tax filings, ensuring your team is paid accurately and on time.

Business Consulting (CPA Consulting)

Strategic CPA consulting tailored to your business goals. We provide expert financial insights, identify growth opportunities, and offer solutions to improve operational efficiency and profitability.

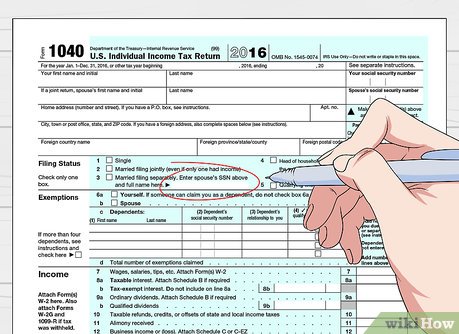

Tax Preparation and Planning

Comprehensive tax preparation and proactive planning to minimize liability and ensure compliance. We help individuals and businesses navigate complex tax laws and optimize their tax strategies year-round.

Bookkeeping

Accurate and timely bookkeeping services to help you maintain organized financial records, track cash flow, and make informed business decisions. We use trusted tools to ensure your books are always up to date.

Resume

Education

CPA USA

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

CMA (IMA – USA), Qualified

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

MBA in Finance

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

BSc (Hons) in Accounting & Financial Management

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Experience

CEO & Managing Partner

• Advising Client • Budgeting and Forecasting • Bookkeeping • Payroll Management • Inventory & Working Capital Management • Tax Preparation & Advising • Credit Analysis • Investment Decision Analysis